Private Health Insurance can sometimes be confusing, especially when it comes to understanding what you can claim and what is an out-of-pocket cost.

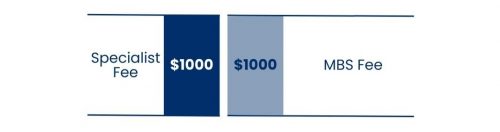

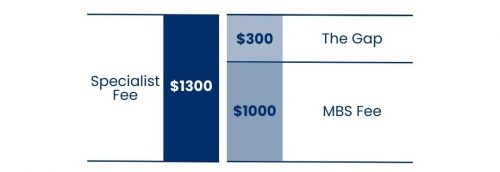

Put simply, an out-of-pocket cost is the difference between the amount a doctor charges for a medical service and what Medicare and your private health insurer pays. This difference is more commonly known as ‘the gap’.

Why Is There A Gap?

Who Pays The Gap?

How Navy Health’s Access Gap Cover Scheme Works

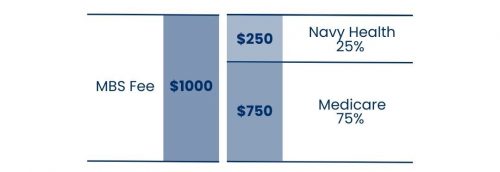

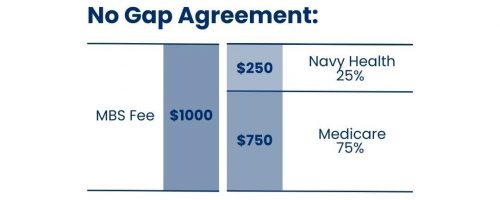

Navy Health’s Access Gap Cover Scheme aims to reduce or eliminate the gap and therefore any out-of-pocket expenses you may pay when being treated in a private hospital.

There are 3 different types of gap cover agreements:

1. No Gap Agreement: where the doctor agrees to charge the MBS price, so you don’t have to pay any out-of-pocket costs as it will all be covered by your private health insurance and Medicare.

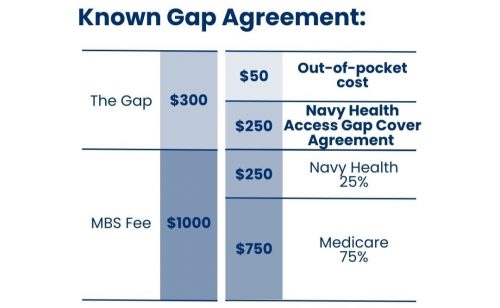

2. Known Gap Agreement: where the doctor sets an agreed price with Navy Health, so you pay a reduced known amount, and Navy Health pays an agreed amount over the MBS.

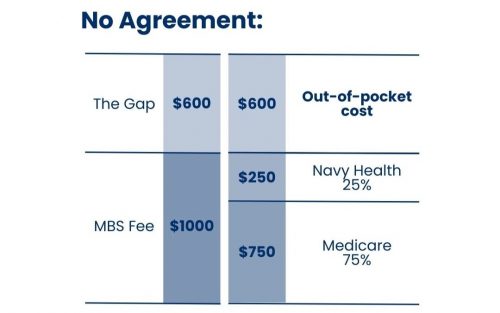

3. No Agreement: where the doctor doesn’t set an agreed price and they can charge at their discretion.

Each doctor can choose to participate in a health insurers gap cover scheme. To search for a doctor that may participate in gap schemes with Navy Health, you can visit our search engine here.

Benefits of Access Gap Cover

The gap cover scheme provides transparency, with specialists offering an Informed Financial Consent document before treatment that details all costs, including gaps. It also controls costs by capping expenses, making healthcare costs predictable, and allows flexibility by letting you choose specialists who match your financial preferences.

How to Use Gap Cover

- Check Your Policy. Before undergoing treatment, review your Navy Health policy to ensure it includes hospital cover for your procedure.

- Find a Participating Specialist. Use our search engine here to find a doctor that may participate in gap cover schemes from Navy Health. Or alternatively you can ask your current specialist if they will participate for this procedure

- Ask Your Specialist. Discuss all potential costs with your doctor and insurer before your procedure and confirm their participation in an agreement.

- Obtain Informed Financial Consent. Before your procedure, request an Informed Financial Consent document from your doctor. This outlines the costs, including any gap you may need to pay. Knowing this information upfront helps you avoid surprises.

What Should I Ask My Specialist? (e.g. Surgeon, Anaesthetist etc.)

Medical costs will vary depending on your individual situation, so here’s a handy list of questions you can ask your Specialist:

• Would you treat me under Navy Health’s Access Gap Cover arrangements?

• Will I incur any personal out of pocket expenses for my treatment and, if so, can you give me a written estimate of how much?

• Will any assisting Specialists also use Navy Health’s Access Gap Cover?

• Are you prepared to send the bill to my fund directly so that they can claim the Medicare benefit on my behalf and send the payment back to you?

Important Information

Participation in the gap cover scheme is voluntary for specialists and applies only to inpatient hospital services. No hidden fees are allowed under the scheme, ensuring transparency.

Each gap cover agreement is per individual MBS item. If you are being treated for multiple MBS items then you may need multiple agreements.

If your specialist doesn’t participate, you have the right to use your medical referral to search around and find another specialist who does.

Need More Information?

If you’re unsure about your cover or have further questions, you can contact our Navy Health Member Services Team on 1300 306 289 or email query@navyhealth.com.au.

Disclaimer

The information in this article is for general information only. Navy Health is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this article relates to your unique circumstances. Navy Health is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.