UNDERSTANDING GOVERNMENT PENALTIES AND INCENTIVES

The Australian Government uses penalties and incentives to encourage people to take out and maintain private health insurance. These rules may affect your view on whether or not you should take out private health insurance.

UNDERSTANDING GOVERNMENT PENALTIES AND INCENTIVES

The Australian Government uses penalties and incentives to encourage people to take out and maintain private health insurance. These rules may affect your view on whether or not you should take out private health insurance.

There are two government penalties in place to encourage you to take out private health insurance: the Medicare Levy Surcharge and Lifetime Health Cover Loading (LHC Loading).

Whilst in service with the ADF, you may have been exempt or partially exempt from these penalties, as the Government considers you as having held the equivalent of private health insurance throughout your service. However, when discharging these penalties may impact you and/or your family.

There is one government incentive to make private health insurance more affordable and that is the Australian Government Rebate on Private Health Insurance.

Medicare Levy Surcharge

The Medicare Levy Surcharge (MLS) is a fee placed on Australian taxpayers who earn above the MLS income thresholds and do not hold an appropriate level of private Hospital cover for themselves, their spouse, and dependent children.

Lifetime Health Cover Loading (LHC Loading)

LHC Loading is a financial penalty which is applied to the cost of private health insurance premiums for those individuals who do not take out private Hospital cover before the 1st July following their 31st birthday.

Australian Government Rebate

The Australian Government Rebate on private health insurance is a portion the Government pays towards your private health insurance to make it more affordable.

What is the Medicare Levy Surcharge?

The Medicare Levy Surcharge (MLS) is a fee placed on Australian taxpayers who earn above the MLS income thresholds and do not hold an appropriate level of private Hospital cover for themselves, their spouse, and dependent children. While most Australian taxpayers currently contribute to the public health system through an annual 2% tax payment, called the Medicare Levy, the Medicare Levy Surcharge acts as an additional tax on top of the Medicare Levy for those who do not hold private Hospital cover. The rate can be up to an additional 1.5% of your income, so the higher your income, the higher the taxable amount will be.

The primary purpose of the Medicare Levy Surcharge is to alleviate demand on the public healthcare system by incentivising Australians to take out private health insurance.

While treatment in a public hospital is free of charge, Australia’s public hospitals are dealing with a number of challenges, with waiting times for elective surgeries having blown out to several years in some cases. By encouraging individuals to take out private health insurance, the government hopes to divert some of the demand for healthcare services away from the public hospital system, which can lead to shorter waiting times and improved access for low-income families who rely on public healthcare.

As an ADF serving member, you would have been exempt from paying the Medicare Levy if you were single or only required to pay 1% if you had a spouse. After you discharge, unless you are entitled to a Gold card this will likely increase to 2% at tax time.

How can I avoid paying the Medicare Levy Surcharge?

In the 2025-2026 income year, commencing July 1, individuals earning above $101,000, as well as families and couples earning over $202,000, may have to pay the Medicare Levy Surcharge. If you want to avoid paying the Medicare Levy Surcharge, you will be required to take out and maintain an appropriate level of private hospital cover for you and any dependents for the full financial year.

This means having a policy which covers you as a private patient in a private hospital. All Navy Health Hospital policies qualify as an appropriate level of cover. This includes our Premium Gold, Core Silver+ and Saver Bronze+ Hospital products.

For further information, please refer to the Medicare Levy Surcharge page on the Australian Taxation Office website.

To compare all our available policies, click the button below.

What is Lifetime Health Cover Loading (LHC)?

Lifetime Health Cover Loading is a government initiative designed to encourage people to take out and maintain private hospital cover earlier in life. LHC Loading is a financial penalty which is applied to the cost of private health insurance premiums for those individuals who do not take out private Hospital cover by 1st July following their 31st birthday.

If you don’t hold private Hospital cover by the 1st of July following your 31st birthday, and instead choose to take it out later in life, you will most likely incur Lifetime Health Cover Loading. For each year past your 30th birthday, you will pay an additional 2% on your premium, up to a maximum of 70%.

For example, if you were to take out private Hospital cover at the age of 40, you will pay 20% more than someone who first took out and maintained their hospital cover at the age of 30.

Once an LHC loading is applied to your health insurance premium, you will need to hold Hospital Cover for 10 consecutive years before the loading is removed.

Is anyone exempt from LHC?

There are also a number of special circumstances, such as living overseas or serving in the ADF, which can affect the LHC Loading rules. Full LHC penalties do not apply if:

- You discharged from the ADF after the 1st of July following your 31st birthday and took out Private Hospital Insurance within 1094 days.

- You discharged from the ADF at 31 years or younger, and took out Private Hospital Insurance by 1st July following your 31st birthday.

- You hold a Veteran Gold Card. You are considered to have applicable Hospital cover from the date the Gold Card was issued.

- You are overseas on the 1st of July following your 31st birthday. You will not pay LHC if you take out private Hospital cover within 12 months of returning to Australia.

- You were born on or before the 1st of July 1934. You are exempt from all LHC rules.

To read more about Lifetime Health Cover Loading, please click here.

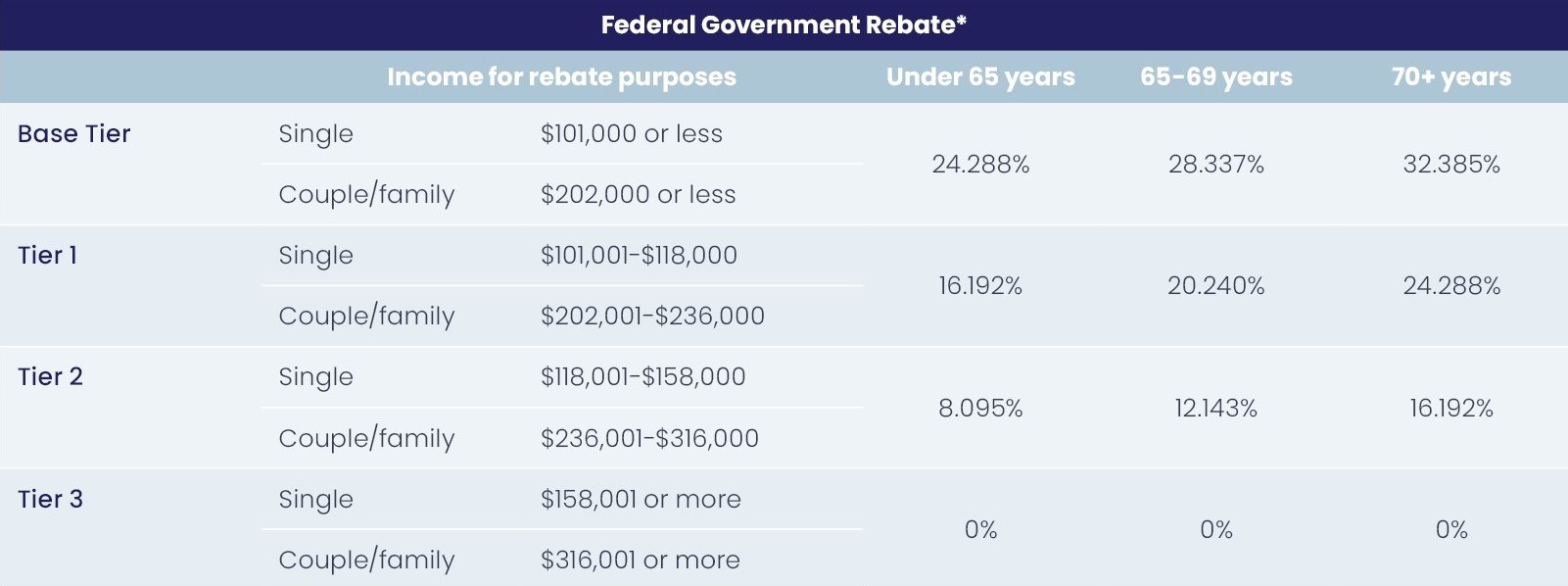

What is the Australian Government Rebate?

The Australian Government Rebate on private health insurance is a portion the Government pays towards your private health insurance to make it more affordable. Depending on your income and age, the rebate can help reduce your premium, so you may pay less while continuing to access the benefits private health cover has to offer.

The Australian Government Rebate is based on your age and income. A higher income generally means you will receive a lower rebate, or you may not be entitled to any rebate at all.

If everyone covered on the policy has full Medicare eligibility, you can register a rebate on your policy. If you earn up to $158,000 as a single, or up to $316,000 as a family, couple, or single parent, you are eligible to receive a rebate.

The rebate levels that apply from 1 July 2025:

Note: Single parents and couples (including de facto couples) are subject to family tiers. For families with children, the income thresholds are increased by $1,500 for each child after the first.

If you’re unsure which rebate tier applies to you, the ATO offers a Private Health Insurance Rebate Calculator to help you determine your applicable income tier.

How do I claim the rebate?

If you are currently paying for health insurance and your income threshold allows you to claim the rebate, you can claim it as a premium reduction or claim it in your annual tax return if you’re not currently doing so.

Through premium reductions

Navy Health can apply the rebate to reduce your health insurance premiums. To do this, you can complete the rebate registration form or call us and complete it over the phone.

In your tax return

If you don’t register a rebate on your Navy Health policy, you can claim the rebate as a lump sum through your annual tax return. The ATO can apply the rebate automatically when you enter your private health insurance information.

Overestimating the rebate and claiming more than you’re eligible for during the year will result in an overpayment, and you will need to pay back at tax time.

Still unsure?

If you still have any questions regarding the Government penalties and incentives, and how they may affect you, please feel free to contact our Member Services team on 1300 306 289, or email query@navyhealth.com.au.