The private health insurance rebate makes having health cover more accessible and affordable. It is a financial contribution provided by the Australian Government towards the cost of private health insurance premiums and is an incentive for individuals and families to take out and maintain private health cover.

Your income tier and age will determine the percentage of the rebate you are eligible to receive. There are four income tiers for singles and families, each with different rebate percentages. Therefore, depending on your income and age the rebate may help you reduce your premium, so you can pay less while getting the benefits private health cover has to offer.

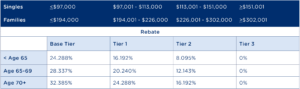

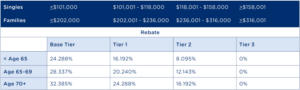

Rebate Thresholds

The new rebate levels that apply from 1 April 2025 up to and including 30 June 2025 are:

From 1 July 2025, the income thresholds will be increased to the following new levels:

Note: Single parents and couples (including de facto couples) are subject to family tiers. For families with children, the income thresholds are increased by $1,500 for each child after the first.

What happens if you claim the wrong rebate amount?

If from 1 July, you claim a higher rebate than you are eligible for on your Navy Health premium, the wrongly claimed amount will be added as a liability to pay back on your tax return for that year. If you think you’ll be affected, we recommend you nominate your rebate amount by completing the Rebate Tier Change form.

To Change Your Nominated Rebate Tier

You are able to change your nominated rebate tier by completing the Rebate Tier Change form.

Alternatively, you can call us on 1300 306 289 or email query@navyhealth.com.au.

To Start Claiming the Rebate

If you are not currently claiming the rebate, and the new income thresholds now allow you to do so, you can claim this as a premium reduction by completing and submitting a rebate application form.

If you have any questions about claiming the rebate, or how the new income thresholds apply to you, please don’t hesitate to call us on 1300 306 289.

What happens if you drop your health cover?

If you fall into Tier 1, 2, or 3 and you don’t have private hospital cover, you’ll incur the Medicare Levy Surcharge (MLS) on your taxable income.

If you’re a serving member of the ADF, you’re currently exempt from the Medicare Levy Surcharge. However, if you have combined income with your partner, you won’t be exempt, and your combined household income will be used to calculate the MLS.

For more information, visit our article on the Medicare Levy Surcharge.