Transitioning from ADF?

We are here to help.

We know that transitioning from ADF to civilian life can be overwhelming so here’s a quick overview on everything you need to know about navigating the public and private health systems.

Transitioning from ADF?

We are here to help.

We know that transitioning from ADF to civilian life can be overwhelming so here’s a quick overview on everything you need to know about navigating the public and private health systems.

Transitioning from the ADF

Navy Health has a long history of serving the Defence force. We understand that the transition from ADF to civilian life can be challenging, especially since the healthcare system can be confusing. Joining a health fund is a significant change for our members who are separating from the ADF. Navy Health’s dedicated Member Services team are here to assist and answer any questions you might have about Private Health Insurance.

What you need to know

We’re here to make your transition from ADF to civilian life easy. We will help you understand your choices when it comes to Medicare, the public health system and the private system.

What is Medicare?

Medicare provides you with access to a range of medical services such as doctors, lower cost prescriptions and free care as a public patient in a public hospital.

When should I start my cover?

Your entitlement to health care from the ADF ends on your separation date. It’s a good idea to get your health cover sorted before you leave Defence to make sure you stay covered.

What are the benefits of private health insurance?

Joining a private health fund gives you and your family the freedom to make choices in your healthcare and gives you benefits for important services not covered in Medicare such as ambulance, dental, physiotherapy and optical.

Government Initiatives

The Australian Government provides various initiatives to encourage you to join a health fund. These initiatives include the Private Health Insurance Rebate, Medicare Levy Surcharge and Lifetime Health Cover Loading.

Navy Health and Defence

Navy Health has been serving the Defence community since 1955. We understand your needs, so to make transitioning easier, we waive waiting periods if you join within 90 days of separating (where membership starts from the day of discharge).

Department of Veterans’ Affairs Cards

You may be eligible for a Veteran White or Gold card. These cards are issued by the Department of Veterans’ Affairs and give you access to various healthcare services.

Required documentation for transitioning ADF members

As a transitioning ADF member joining Navy Health, to have your waiting periods reviewed and avoid full Lifetime Health Cover loading, we ask that you please provide one of the following documents* indicating your enlistment and discharge dates:

Discharged before October 1, 2024:

• ADF Private Health Letter

• Interim Certificate of Service

• Certificate of ADF Service

Discharged on or after October 1, 2024:

• Certificate of Appreciation

• Certificate of ADF Service

*We can only accept the documents listed above and are unable to accept Service Records. If you do not currently hold one of these documents, you may be able to obtain a copy by contacting your ADF Transition Centre or Defence Archives Request for Records.

If you are commencing a new policy with Navy Health, this document can be uploaded with your online application. Alternatively, please email through the requested information to query@navyhealth.com.au.

Before transitioning from ADF

While you are serving, your healthcare is covered by the ADF, this entitlement ends on your transition date. Before you leave Defence you should address any health concerns you may have to make the most of this entitlement.

Providing Defence with a comprehensive overview of your health may also be important if you require Department of Veterans’ Affairs assistance in the future.

Medicare

The first step in joining the public health system is to register for Medicare.

All citizens and permanent residents of Australia are eligible for Medicare. If you are single, have never had Medicare before and are separating, you must register with Medicare to access the benefits.

If your family already has Medicare, you can add yourself to the family Medicare card. In either case, you can register prior to separation, but you can’t access benefits until you leave the ADF.

Things to know about Medicare

Doctors

When seeing a doctor, Medicare covers 85% of the Medicare Benefit Schedule (MBS) Fee for general practitioners and specialist out of hospital services (some GP’s may bulk bill which will mean the MBS fee is fully covered).

Other doctors may charge more than the MBS Fee; it is your responsibility to pay the difference, which is not claimable through a health insurance fund.

Prescription Medicines

The Pharmaceutical Benefits Scheme (PBS) subsidises the cost of medicine. To be eligible, the medicine must be listed on PBS. If this is the case, you may pay up to $30 (effective 01/01/2023) and Medicare pays the rest (indexed annually). If a medicine is not on PBS, health insurance can assist with these costs.

Going to Hospital

Medicare covers 100% of the hospital costs when you are admitted to a public hospital as a public patient. As a public patient, the hospital will choose the doctors and specialists who treat you.

In this case, Medicare pays 100% of costs, including after-care by the treating doctor or hospital. It is worth remembering however, that waiting lists apply in the public system and can be significant.

Medicare can assist with services such as

Out-patient

services

Emergency

treatment

Diagnostic

tests

Pharmacy

medication

Department of Veterans’ Affairs

As a former ADF member, you could be entitled to a Veteran Gold Card or White Card. Navy Health offers a 10% discount for Veteran White and Gold Cardholders. Conditions apply.

Veteran Cards, what’s the difference?

Veteran Gold Card

The Veteran Gold Card will provide cover for any clinically necessary health care needs, whether they are related to service or not.

Veteran White Card

The Veteran White Card provides cover for the care and treatment of specifically accepted injuries or conditions that are war caused or service related.

Government initiatives

The Australian Government has put in place some initiatives to encourage you to sign up to health insurance. These initiatives help ease pressure on the public hospital system and make private health insurance more affordable.

The Federal Government Rebate

The Federal Government Rebate is a tax rebate that is applied to everyone who has appropriate health insurance cover for the tax year. The rebate applies to both hospital and extras cover. Your rebate amount is calculated on the basis shown in the table below.

Calculating your rebate

Your rebate amount is calculated on your household income and your age

Income thresholds typically change on 1 July each year

The family threshold increases by $1500 for each child after the first

Rebates are adjusted annually on 1 April. To determine your rebate amount, refer to the Private Health Cover Rebate Calculator on the Australian Taxation Office website.

Lifetime Health Cover Loading (LHC)

The Lifetime Health Cover Loading surcharge activates on 1 July following your 31st birthday and is applied to your premiums. The Government mandates this cost and premiums increase by 2% with every year that you do not take out hospital cover after the age of 30.

The surcharge remains until you have maintained hospital cover for 10 consecutive years.

Please note the following in relation to the LHC:

You are eligible to 1094 days (can be non-consecutive) without hospital cover over your lifetime without incurring this penalty. Special conditions apply for full-time members of the ADF if you discharge after the LHC deadline

If you:

→ Joined ADF prior to 1 July 2000, your entry age will be treated as 30 for LHC purposes on separation

→ Joined on or after 1 July 2000, your age for LHC purposes is that at which you entered the ADF, unless you have previously held private health cover

Please note: your “1094 allowed days without cover” countdown begins immediately after separation unless you have private health cover.

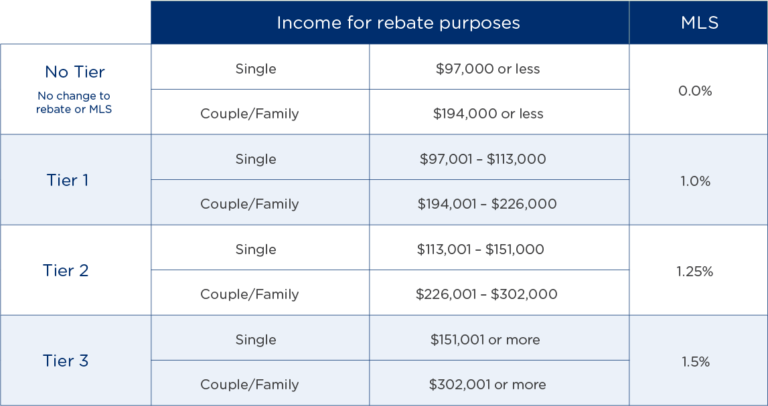

The Medicare Levy Surcharge (MLS)

All Australian taxpayers pay a Medicare Levy of 2% of their taxable income to help pay for Medicare. Click here to find out more about the Medicare levy.

The MLS is an additional tax (on top of the standard 2% Medicare Levy) which is applied to everyone who doesn’t have the appropriate private hospital cover. The level of MLS you are charged is calculated on the below basis.

Medicare Levy Surcharge information correct as of 1 July 2024.

*For families, the income thresholds increase by $1,500 for each MLS dependent child after the first.

Please note: the threshold information above is a general guide only and may vary according to your particular circumstances.

Understanding how the tax system relates to health insurance can be difficult. If you have questions about how these tax incentives relate to your cover, speak to one of our Member Services team on 1300 306 289.

Disclaimer

The information in this article is for general information only. Navy Health is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this article relates to your unique circumstances. Navy Health is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.