From March 2024, we will be no longer be able to issue cheques for claim benefits or accept them for membership premium payments. To nominate an alternative payment method, we ask that you visit the mobile app, OMS, or give us a call.

Do you know which cover is right for you?

Private Health Insurance

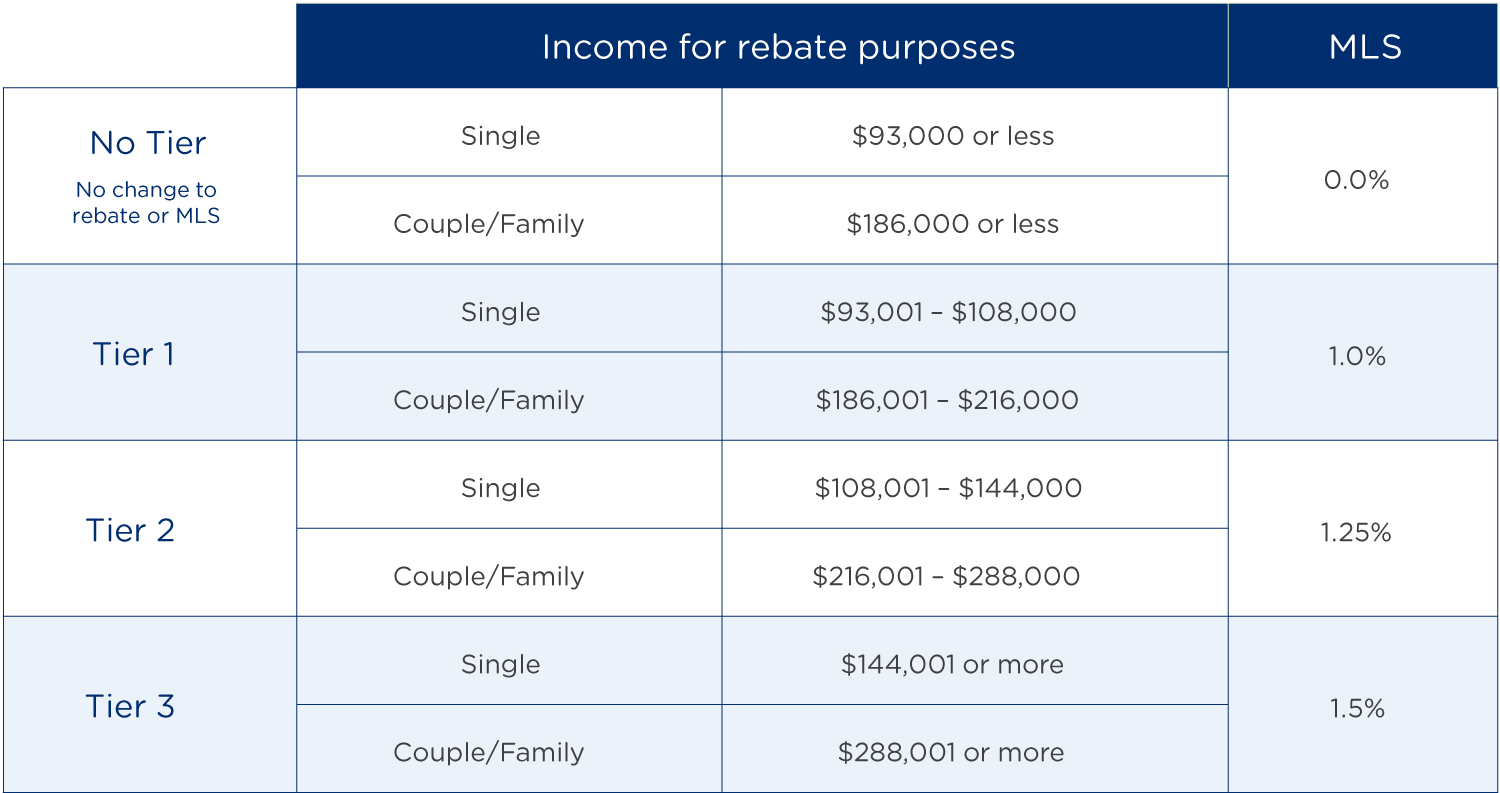

The Medicare Levy Surcharge (MLS) is a fee placed on Australian taxpayers who do not have an appropriate level of private hospital insurance and who earn above a certain income. The incentive behind the surcharge is to encourage individuals to take out private hospital cover and to use the private hospital system to help alleviate some of the demand on the public Medicare system.

The surcharge is calculated at the rate of 1% to 1.5% of your income. It is in addition to the Medicare Levy of 2.0%, which is paid by most Australian taxpayers. The Medicare Levy Surcharge covers all people on your policy.

Medicare Levy Surcharge Thresholds: Refer to table at the bottom of the page.

Single parents and couples (including de facto couples) are subjected to family tiers. For families with children, the thresholds are increased by $1500 for each child after the first.

You may also be subject to the MLS, if your taxable income is over the threshold and you have a dependent who is not currently covered by an approved health cover.

As an ADF serving member, you would have been exempt from paying the levy if you were single or only paid 1% if you had a family. Although as an ADF member you may not require health insurance, if your combined family income is above $186,001, your family will need to take out private hospital cover to avoid MLS.

If you or your family receive a high income, it is advised to look into private health insurance to avoid the high surcharge.

For further information, please refer to the Medicare Levy Surcharge page on the Australian Taxation Office website.

Medicare Levy Surcharge information correct as of 1 July 2023.

© Navy Health Ltd All Rights Reserved 2023

Privacy Policy Terms & Conditions Code of Conduct

© Navy Health Ltd All Rights Reserved 2023

© Navy Health Ltd All Rights Reserved 2023