From March 2024, we will be no longer be able to issue cheques for claim benefits or accept them for membership premium payments. To nominate an alternative payment method, we ask that you visit the mobile app, OMS, or give us a call.

Do you know which cover is right for you?

Information to help you get started as a Navy Health member.

Understand eligibility, the Medicare Levy Surcharge, the Private Health Insurance Rebate, Lifetime Health Cover and every other in and out of health insurance.

What you need to know about your membership including the different ways you can make a claim.

Important information about your cover including excesses, pre-existing conditions and waiting periods.

Start by selecting a category or searching for what you are looking for.

Back

Back

Am I eligible for Navy Health?

At Navy Health, we like everyone to reap the benefits of a not-for-profit company!

Don't let the word restricted stop you! More than likely you are eligible for Navy Health's low premiums and high benefits.

Once you're a member of Navy Health you are entitled to lifetime membership eligibility. Therefore, if you've been eligible at any stage in your life, you're welcome to join at any time in the future, even if you're leaving the ADF or an Australian Defence contracted company. We call this our Member for Life clause.

Navy Health is a tri-service health fund open to:

| • | Serving or ex-serving members of the Australian Defence Force (Navy, Army and Air Force) |

| • | Ex-dependants of serving and ex-serving members of the Australian Defence Forces |

| • | Employees of organisations contracted to provide services to the Department of Defence |

| • | Employees of the Department of Defence |

| • | Australian Public Service employees assigned to, or directly engaged to provide services to the Department of Defence or ADF |

| • | Current members or former members of the ADF Reservists |

| • | Current members or former members of the ADF Cadets |

| • | You may also be able to join Navy Health if you are related to any eligible person (above) or any person who was a member of Navy Health as at 12 October 2007, in any of the following ways; → Partners → Siblings → Children → Grandchildren → Parents |

If you’re still not sure, call us on 1300 306 289.

Back

Back

Once accepted as a member of Navy Health you are entitled to lifetime membership eligibility. This means that you or your family members can join Navy Health in their own right at ANY time in the future.

Therefore if you:

| • | Discharge from the ADF |

| • | Need a period without Private Health Insurance |

| • | Would rather wait until later in life to take up Private Health Insurance |

...you and your family will still be eligible!

Lifetime eligibility means that you will have access to all the benefits of a not-for-profit organisation that ensures benefits are given back to members allowing for lower premiums and higher benefits.

Check your eligibility using our simple tool.

Back

Back

Before completing the application forms, please ensure you have read and understood the Terms and Conditions of membership, any waiting periods and exclusions that may apply to the cover you have selected, as outlined in the complete health cover brochure.

Back

Back

Veteran White and Gold Cardholders are eligible for a 10% discount off their premiums with Navy Health.

Veteran Cards provide a wide range of access to treatment and services such as hospital treatment, dental care, optical services and more. You may also be covered for particular pharmaceutical needs and rehabilitation devices. A Veteran White Card provides cover and treatment of specifically accepted injuries or conditions that are war caused or service related. A Veteran Gold Card will provide cover for any clinically necessary health care needs, whether they are related to war service or not.

Please find below some frequently asked questions relating to the Veteran Discount. If your question is not answered below please call the Member Services Team on 1300 306 289 for assistance.

How do I apply for the Veteran Discount?

To activate the discount, you will need to send an email to DVACardHolder@navyhealth.com.au with the following information:

| • | Your membership number |

| • | Full name |

| • | Proof of Veteran status (scan/copy of Veteran Card) |

I’ve been a loyal member why do I not get a discount?

Navy Health recognises people that have served in the ADF. As a not for profit insurer, we aim to keep costs low for all members and provide more benefits to lessen the out of pocket costs.

I have a Gold Card and my spouse is the only one on the membership. Can we get the discount?

The discount can only be applied if the person who holds the Veteran Gold Card is covered under the membership. As a Gold Cardholder, you do not necessarily need health insurance as most of your health costs are already covered. However, you may choose to take Extras only to cover those services that the Gold Card may not specifically provide benefits for.

I have been a Veteran Cardholder for xxx, can I backdate?

The discount cannot be backdated.

I used to be a Veteran Cardholder, can I still get the discount?

The discount is only available to current Veteran Cardholders.

I will receive a Veteran Cardholder when I turn 70, can I get the discount now?

The discount is only available to current Veteran Cardholders.

My parent/grandparent/sibling is a Veteran Cardholder, am I entitled to the discount?

The discount is only available to current Veteran Cardholders.

My Veteran White Card covers my heart condition, can that be removed from my policy and retain the discount?

No, Navy Health policies cannot be tailored to suit individual requirements. We would be happy to discuss your cover to ensure you are on the most appropriate level for your needs.

I don’t require hospital cover, can I take an Extras only policy and still receive the discount?

Yes, you can take an Extras only policy and have the discount applied.

I have been issued a Veteran Gold Card – should I remain on the membership?

Members become Veteran Gold Cardholders have the option of retaining or cancelling their cover with Navy Health.

Where a member chooses to retain their coverage, benefits will be paid on out-of-pocket costs incurred after the Veteran Card payment; however, the amount must not exceed the total charge or the Navy Health benefit limits. For members with a Veteran Gold Card who hold top hospital coverage, Navy Health will pay the supplement (top-up) benefit for a private room in a private hospital.

Where a member chooses to cancel their coverage, they must advise Navy Health either over the phone or in writing. The cover will be cancelled from the date Navy Health receives the notification. The person holding the Veteran Gold Card may re-apply for membership to Navy Health without waiting periods or penalties.

If the Gold Card is revoked, the person is entitled to re-join Navy Health without serving any waiting periods, provided their cover commences from the day after the Veteran Gold Card was withdrawn. Proof of previous Veteran Gold Card status is required.

Back

Back

We know transitioning from defence and entering in to civilian life can be overwhelming. Therefore, we have developed a guide here to help you navigating the public and private health systems.

Back

Back

There are no qualifying periods if you are accepted for membership after transferring a current membership from another Australian Registered Private Health Insurer and had an equivalent level of cover, and completed all waiting periods*.

Normal waiting periods will apply to those aspects of Navy Health cover not covered previously by your previous insurer, and for those items specifically nominated within the products as requiring extended waiting periods. Waiting periods will also apply if you join Navy Health after 30 days from leaving your previous health insurer.

Navy Health will not pay immediate benefits at a higher level than those provided by the previous insurer. Navy Health annual limits will be reduced by the amount of benefit already paid by the previous insurer for similar services in the current benefit year of transfer. The Clearance Certificate Application may assist you with your transfer to Navy Health.

*Please note: Waiting periods will apply if joining Navy Health after 30 days from leaving your previous health insurer.

Back

Back

A dependant is defined as a child, legally adopted child or stepchild who is unmarried and who has not attained the age of 22 years.

A student dependant is defined as a child, legally adopted child or stepchild who is under the age of 25 and not married or in a de facto relationship, and who is pursuing a fund approved full-time course of study at school, college or university.

If a non-student dependant takes up any extras cover within 30 days of being ineligible to continue under a parent’s membership, Navy Health will allow the dependant to retain the hospital cover provided under the existing family membership until they attain 25 years of age, marry, or enter into a de facto relationship.

Continuity of hospital cover, at an equivalent level of cover to that carried over from a parent’s membership will be provided when the dependant seeks cover in their own right provided the parent’s membership is still current and cover is activated within 30 days of being ineligible for inclusion under a parent’s membership. A dependant can take up membership in their own right at any time after being ineligible to continue under their parent’s cover, however some waiting periods may apply unless membership is taken up within 30 days.

Back

Back

Defence Discounts

As an acknowledgement of your commitment and sacrifice, we offer a 10% discount* to Veteran Cardholders, ADF Active Reservists, and the family of full-time serving ADF members. The discount can be applied regardless of the level of cover you hold.

Veteran Cardholders

To qualify for the 10% Veteran Card discount:

To have this discount applied, please send a copy of the Veteran White or Gold card to DVACardHolder@navyhealth.com.au.

ADF Active Reservists

To qualify for the 10% Active Reservist discount:

To have this discount applied, please send through proof of your current SERCAT status (must be SERCAT 3 or above) to query@navyhealth.com.au.

Current Full-Time Serving ADF Members

To qualify for the 10% Serving Member discount:

To have this discount applied, please send a copy of the serving member’s ADF ID card or a screenshot of their PMKeyS to query@navyhealth.com.au.

Defence Bank discount

Do you hold an account with Defence Bank? If so, you may be eligible for a 5% discount* on your Navy Health policy. To be eligible for this discount:

If you are eligible based on the above criteria, please contact us on 1300 306 289 to discuss.

Payment frequency discounts

Payment frequency discounts* are available to members who choose to pay via direct debit. Navy Health offers a 2% discount for 6 monthly and 4% for 12 monthly direct debit payments. Please call us on 1300 306 289 to see if you are eligible for a payment frequency discount on your policy.

* Discounts cannot be backdated and will be applied from the date we receive the requested information. Only one discount can be applied per policy. Discounts are not available on corporate covers.

Back

Back

Medicare is Australia’s national public health scheme which covers medical services, public hospitals, and medicines.

Medicare is available to Australian and New Zealand citizens, permanent residents in Australia, and people from counties with reciprocal agreements.

Medicare covers all the costs of public hospital services. It also covers some or all the costs of other health services. These can include services provided by GPs and medical specialists. They can also include physiotherapy, community nurses and basic dental services for children. However, there are some medical services that Medicare does not cover, such as ambulance transport, most dental services and contact lenses or glasses.

The other important part of Medicare is the Pharmaceutical Benefits Scheme (PBS). The PBS makes some prescription medicines cheaper.

To read more about how Medicare works please click here.

Back

Back

Many Australians have private health insurance cover. There are two kinds of cover:

• Hospital Cover for some (or all) of the costs of hospital treatment as a private patient.

• General Treatment (‘ancillary’ or ‘extras’) Cover for some non-medical health services not covered by Medicare — such as dental, physiotherapy and optical services.

Some people with private health insurance have either hospital cover or extras cover, and some people have both.

The Australian Government provides a means-tested rebate to help you with the cost of your private health insurance.

In Australia, private health insurance allows you to be treated in a hospital as a private patient and can be designed to “fill the gaps” in Medicare’s coverage and give you more choice about where you can be treated.

Joining private health insurance is a popular choice for many Australians who want help in avoiding the long wait times of the public health system and want to be treated by a doctor of their choice sooner.

To get more information on advice about the Australian Health Insurance Industry and the wide range of service providers click here.

Back

Back

Going to Hospital can be a stressful time, so the last thing you or your family should need to worry about is excessive out of pocket expenses. This is where Navy Health’s Access Gap Cover scheme can assist.

Navy Health’s Access Gap Cover scheme aims to minimise the difference between the Medicare fee and what your Specialist charges. Specialists can choose to take part in Access Gap Cover on a case-by-case basis; if they take part you’ll either have no gap or be told exactly what your out-of-pocket costs will be. Even if your Specialist elects not to take part, you are legally entitled to know any out-of-pocket cost before your procedure – ask your Specialist.

The Australian Government sets a Medicare Benefits Schedule (MBS) fee for most services. Procedures recognised by Medicare will have a set MBS ’item number’ and fee. However, Specialists can charge their patients more than the MBS fee if they choose to do so. Medicare and Navy Health cover the cost of the MBS fee for in-hospital treatments but any extra amount charged by the provider becomes an out-of-pocket cost to you.

MBS fee breakdown:

| • | Medicare pays 75% of the MBS fee for in-hospital treatment as a private patient. Navy Health will pay the remaining 25% of the MBS fee. |

| • | Medicare pays 85% of the MBS fee for out-of-hospital services. Australian Private Health Insurers are legally prohibited from, and cannot provide benefits for services provided out of hospital. |

Example

Sally is going to hospital to receive treatment for Medicare item number 12345 which has a set MBS fee of $1000. However Sally’s Specialist, Dr Smith, will be charging $1200 to provide this treatment. In this instance, Medicare will pay $750 (75% of the MBS fee), Navy Health will pay $250 (the remaining 25% of the MBS fee) meaning Sally will have to pay Dr Smith the extra $200. This is Sally’s out of pocket expense.

You can ask your Specialist if they will participate in Navy Health’s Access Gap Cover scheme. Our Access Gap Cover scheme allows us to provide benefits to our members to cover some or all of the gap.

Things to note:

| • | There is no requirement for any doctor to participate in Navy Health’s Access Gap Cover scheme; |

| • | You should always ask Navy Health and your Specialist about your Access Gap Cover benefits before you are treated; and |

| • | If there is going to be an amount left for you to pay, the Specialist is legally required to advise you of this before you agree to be treated, wherever practical. They will provide you with a breakdown of costs which will include how much is covered by Medicare and your private health insurance. This is called Informed Financial Consent. |

There are 2 ways the Access Gap Cover scheme can work for you; Known Gap Scheme or No Gap Scheme.

Known Gap Scheme

If your chosen Specialist bills with a Known Gap through Access Gap Cover, your out-of-pocket expenses relating to your in-hospital treatment will be capped. You won’t be charged any additional amounts other than what you’ve agreed to in your Informed Financial Consent before your in-hospital treatment.

No Gap Scheme

If your chosen Specialist chooses to bill you with no gap, you will not have any out-of-pocket expenses for their in-hospital treatment.

Navy Health’s agreements are negotiated by the Australian Health Service Alliance (AHSA).

You have every right to use your current medical referral to shop around for a Specialist that does participate in the scheme. In this case we also encourage you to call Navy Health to discuss your treatment options.

To find Specialists that may participate in the Navy Health Access Gap scheme, go to healthshare.com.au

| • | Ask your Specialist if they will participate in the Access Gap scheme prior to your procedure; |

| • | Navy Health will only pay for services listed on your policy once you have served the applicable waiting periods; |

| • | The Navy Health Access Gap scheme is only available for inpatient services (i.e. when you are admitted to hospital as a private patient); |

| • | Navy Health has no control of the out-of-pocket expenses set by your Specialist if they are not participating in the Access Gap scheme; and |

| • | It is entirely up to your treating Specialist whether they will participate in the Access Gap scheme or not. |

Currently, the Access Gap Cover scheme allows Specialists to charge a patient up to $400 for each Medicare item number that is used for treatment in hospital as a private patient. There can be multiple Medicare item numbers used during the procedure, depending on what the patient is being treated for.

A Specialist could also charge a patient a booking or administration fee not associated with the Medicare item number

Effective 1 July 2020, the maximum an individual Specialist can charge under the Access Gap Cover scheme is $500, per admission to hospital (as a private patient). Specialists can no longer charge fees not associated with the Medicare item number.

The changes apply to all Navy Health members that include hospital cover on their membership.

What should I ask my Specialist?

Simply ask your Specialist if they will treat you under the Access Gap Cover (AGC) scheme.

If they agree, you will only pay up to $500 per Specialist per hospital stay (as a private patient) ($800 for obstetrics). They may even agree to charge ‘no gap’, which will means you will not have any additional out-of-pocket fees for their services.

Specialists can decide to participate in the AGC scheme on a case-by-case basis, they are not obliged to treat you under this scheme.

What does ‘No Gap’ mean?

‘No Gap’ is where the provider charges the AGC amount with no additional charge to the patient.

What is ‘Known Gap’?

‘Known Gap’ is where the Specialist can charge up to the maximum AGC amount, $500 per individual Specialist ($800 for obstetrics), so the patient has a gap (also known as the ‘out of pocket’).

It is called a ‘Known Gap’ because written Informed Financial Consent (IFC) is required under AGC prior to the procedure, which means the patient ‘knows about the gap’ before they receive their medical bill.

What are additional fees?

If a provider chooses to use AGC, they cannot charge any ‘additional fees’ or hidden fees. These additional or hidden charges include booking fees, management fees, technology fees, administration fees and any other fees that are not a professional service described by the Medicare Benefits Schedule (MBS) item number.

What is a Medicare item number?

The Medicare Benefits Schedule (MBS) is a large listing of medical services covered and subsidised by the Australian government. Each service listed has its own fee, which is set by the Government. Whether you’ve got Private Health Insurance or are a private patient paying for all your own costs, the government provides a rebate on most medical services.

Your surgeon, anaesthetist and assistant surgeon can each bill their own MBS items for a hospital stay (where you are admitted as a private patient). Together, these MBS items provide a detailed hospital invoice and summary. Before any hospital admission utilising your private hospital cover, it’s a good idea to get an itemised quote of the MBS items applicable to your treatment – known as Informed Financial Consent.

Informed Financial Consent or the written estimate of fees should include:

| • | Details of the proposed procedure including hospital, admission date, procedure details such as MBS items with a description and fee for each; |

| • | Other services or Specialists such as anaesthetist, assistant surgeon, pathologist or radiologist and their fee estimate; |

| • | Medical Devices and Human Tissue Products that may be required and their fee, plus the health fund benefit; and |

| • | Patient or guardian signature and date, as a general acknowledgement of the fees. |

Back

Back

The private health insurance rebate makes having health cover more accessible and affordable. It is a financial contribution provided by the Australian Government towards the cost of private health insurance premiums and is an incentive for individuals and families to take out and maintain private health cover.

Your income tier and age will determine the percentage of the rebate you are eligible to receive. There are four income tiers for singles and families, each with different rebate percentages. Therefore, depending on your income and age the rebate may help you reduce your premium, so you can pay less while getting the benefits private health cover has to offer.

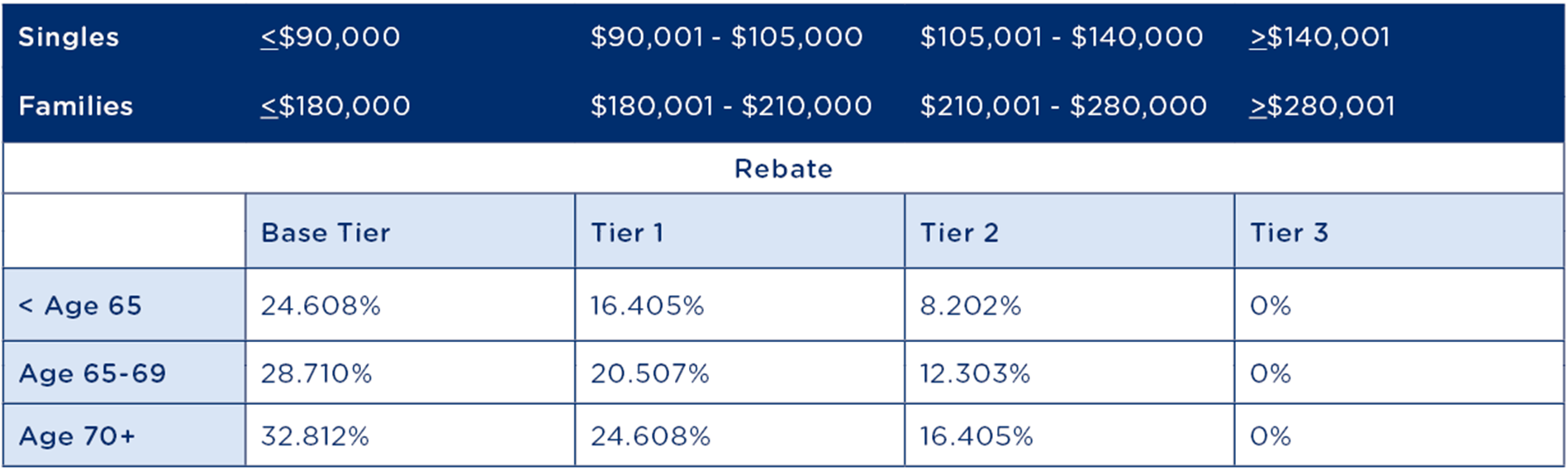

The rebate thresholds applicable up to 30 June 2023 are:

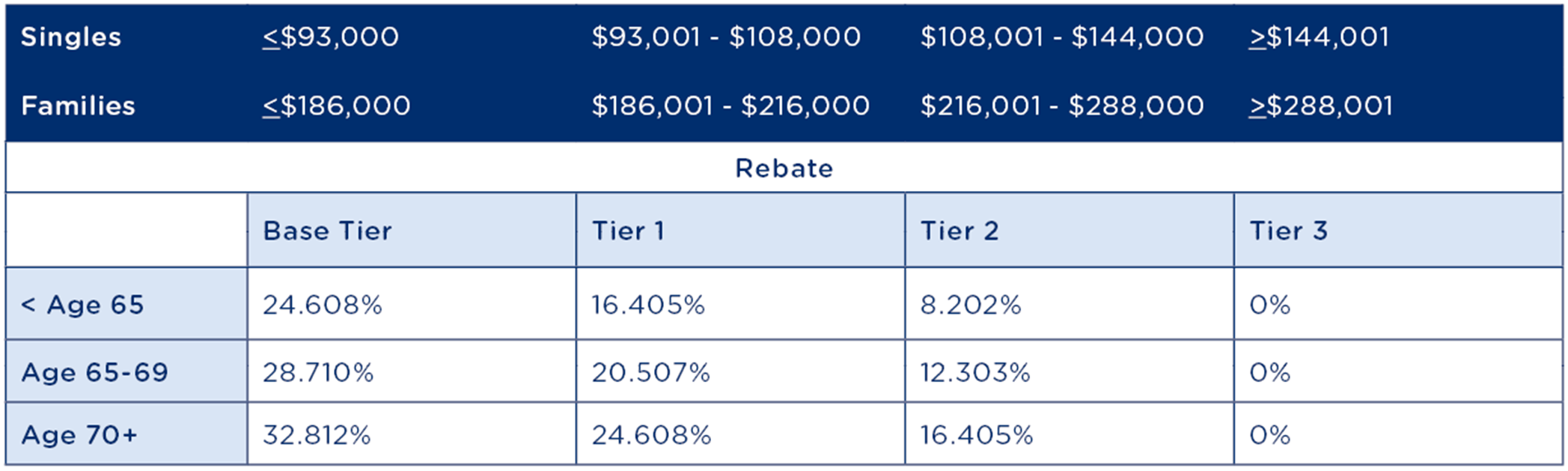

From 1 July 2023, the rebate thresholds will be increased to the following new levels:

Note: Single parents and couples (including de facto couples) are subject to family tiers. For families with children, the income thresholds are increased by $1,500 for each child after the first. Your entitlement is based on the eldest person covered on your policy.

If from 1 July, you claim a higher rebate than you are eligible for on your Navy Health premium, the wrongly claimed amount will be added as a liability to pay back on your tax return for that year. If you think you’ll be affected, we recommend you nominate your rebate amount by logging into Online Member Services.

You can make this change yourself using Online Member Services.

Alternatively, you can also call us on 1300 306 289 or email query@navyhealth.com.au.

If you are not currently claiming the rebate, and the new income thresholds now allow you to do so, you can claim this as a premium reduction by completing and submitting a rebate application form.

If you have any questions about claiming the rebate, or how the new income thresholds apply to you, please don’t hesitate to call us on 1300 306 289.

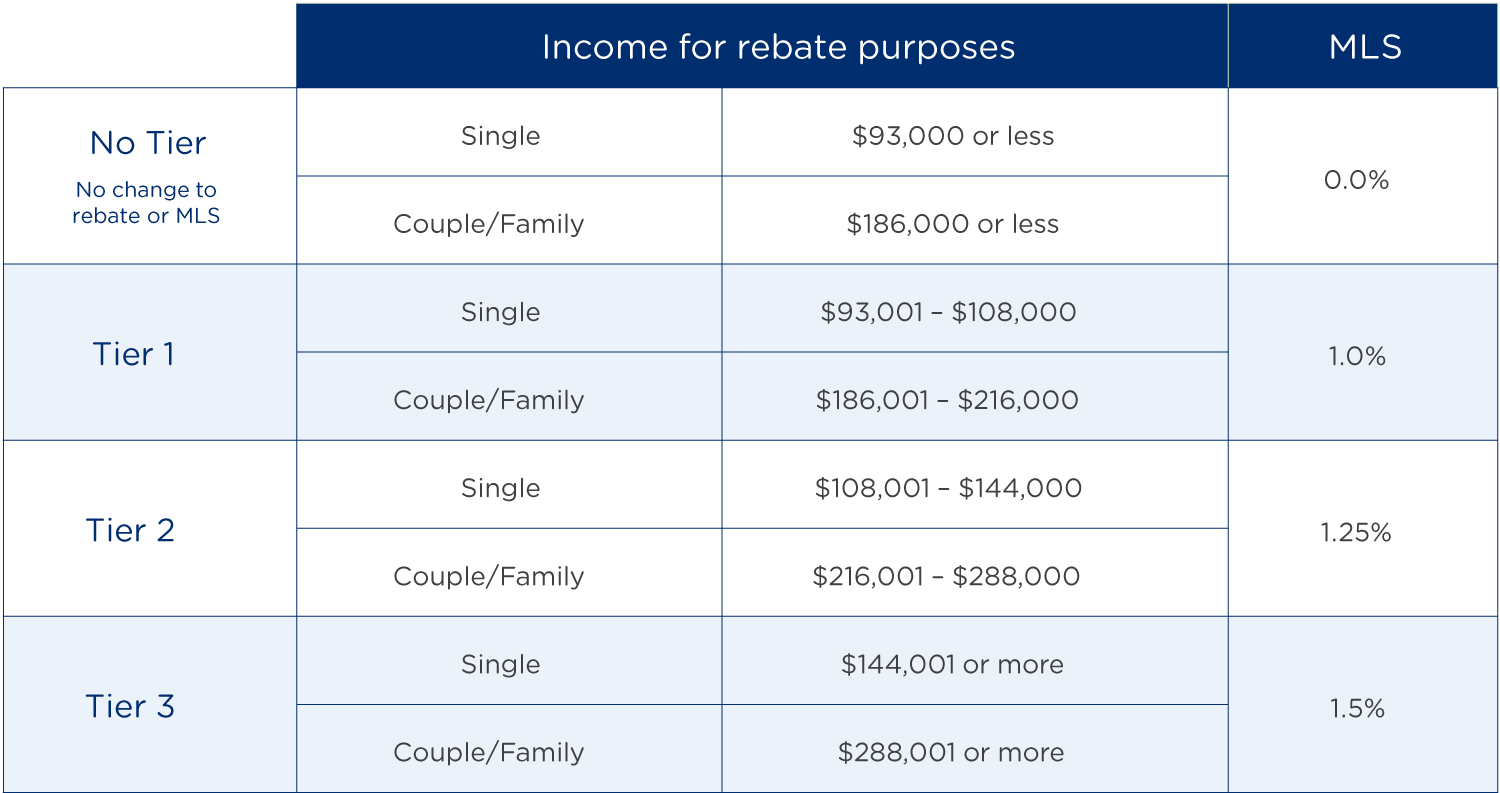

If you fall into Tier 1, 2, or 3 and you don’t have private hospital cover, you’ll incur the Medicare Levy Surcharge (MLS) on your taxable income.

If you’re a serving member of the ADF, you’re currently exempt from the Medicare Levy Surcharge. However, if you have combined income with your partner, you won’t be exempt, and your combined household income will be used to calculate the MLS.

For more information, visit our article on the Medicare Levy Surcharge.

Back

Back

Lifetime Health Cover (LHC) is a Government initiative designed to encourage people to take out hospital insurance earlier in life and to maintain their cover. If you are 30 or over, do not currently hold PHI and have not or are no longer a permanent member of the ADF you may be impacted by Lifetime Health Cover (LHC).

You need to take out a private health insurance hospital policy by the 1st of July following your 31st birthday, to avoid paying LHC loading. For every year you delay, you will pay 2% more for your premium, up to a maximum of 70%. For example, if you take out hospital cover at age 40, you will pay 20% more than someone who first took out hospital cover at age 30.

To cover small gaps, such as switching from one insurer to another, you are able to be without private cover for periods totalling 1094 days (i.e. three years less one day) during your lifetime, without affecting your loading.

Who is exempt from LHC?

| • | if you were born on or before 1 July 1934 |

Special Circumstances

| • | You are a member of the ADF your medical services are provided by the ADF, so you are considered to have hospital cover. If you discharge from the ADF after the 1st of July following your 31st birthday, you have 1094 days to join a health insurer and still pay the base rate. If you discharge from the ADF before the 1st of July following your 31st birthday, then the normal rules apply |

| • | If you hold a Department of Veteran Affairs Gold Card you are considered to have hospital cover from the date it was issued |

| • | You are overseas on the 1st of July following your 31st birthday, you will not pay LHC if you purchase hospital cover upon your return to Australia |

For more information

| • | Visit the Department of Health website |

| • | Visit the PrivateHealth.gov website |

| • | Call Navy Health on 1300 306 289 |

Back

Back

The Medicare Levy Surcharge (MLS) is a fee placed on Australian taxpayers who do not have an appropriate level of private hospital insurance and who earn above a certain income. The incentive behind the surcharge is to encourage individuals to take out private hospital cover and to use the private hospital system to help alleviate some of the demand on the public Medicare system.

The surcharge is calculated at the rate of 1% to 1.5% of your income. It is in addition to the Medicare Levy of 2.0%, which is paid by most Australian taxpayers. The Medicare Levy Surcharge covers all people on your policy.

Medicare Levy Surcharge Thresholds: Refer to table at the bottom of the page.

Single parents and couples (including de facto couples) are subjected to family tiers. For families with children, the thresholds are increased by $1500 for each child after the first.

You may also be subject to the MLS, if your taxable income is over the threshold and you have a dependent who is not currently covered by an approved health cover.

As an ADF serving member, you would have been exempt from paying the levy if you were single or only paid 1% if you had a family. Although as an ADF member you may not require health insurance, if your combined family income is above $186,001, your family will need to take out private hospital cover to avoid MLS.

If you or your family receive a high income, it is advised to look into private health insurance to avoid the high surcharge.

For further information, please refer to the Medicare Levy Surcharge page on the Australian Taxation Office website.

Medicare Levy Surcharge information correct as of 1 July 2023.

Back

Back

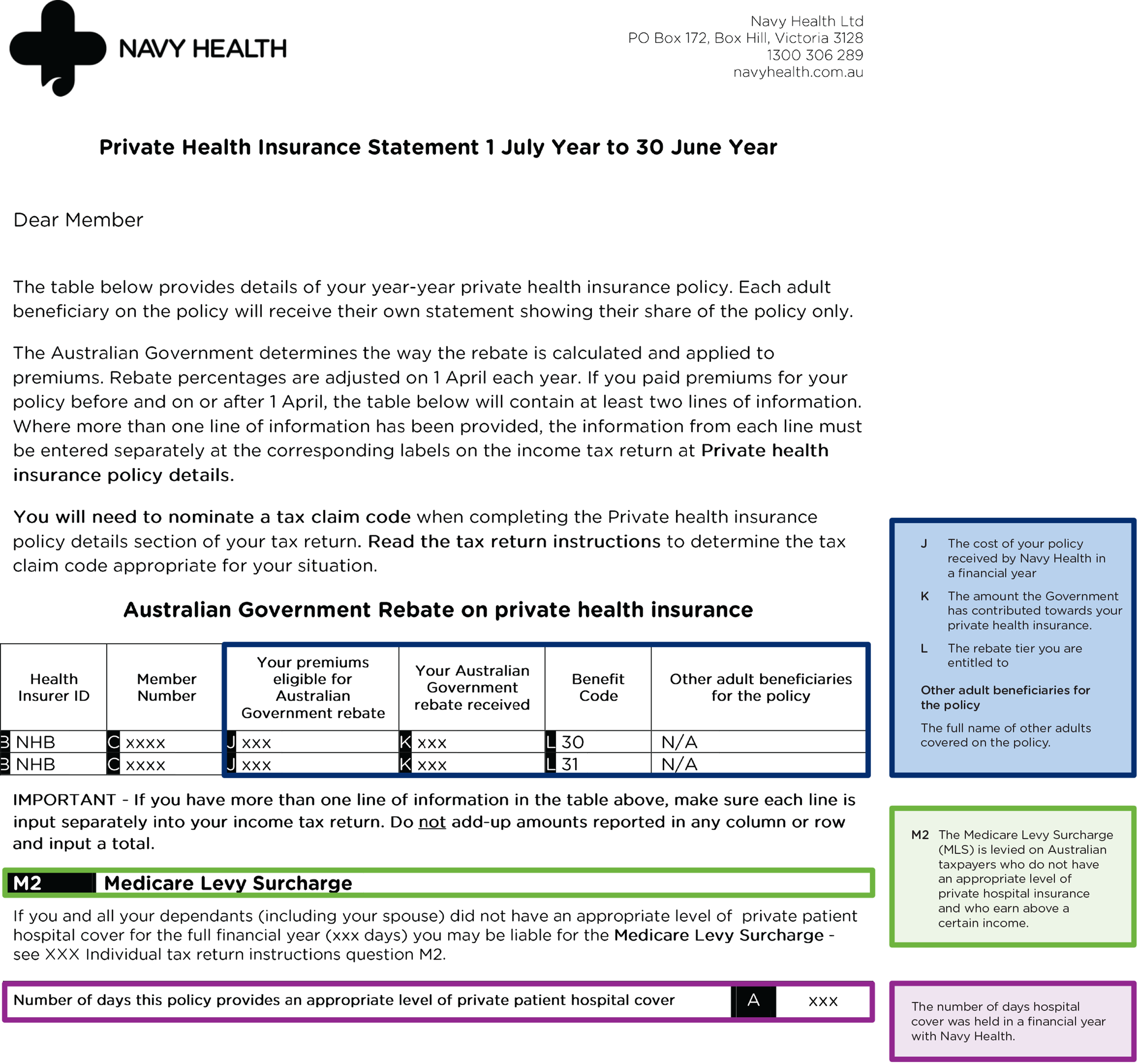

This financial year (2022/2023) Navy Health will send your health insurance tax statement directly to the Australian Taxation Office (ATO).

We will also store the tax statement in Online Member Services no later than 7th July 2023.

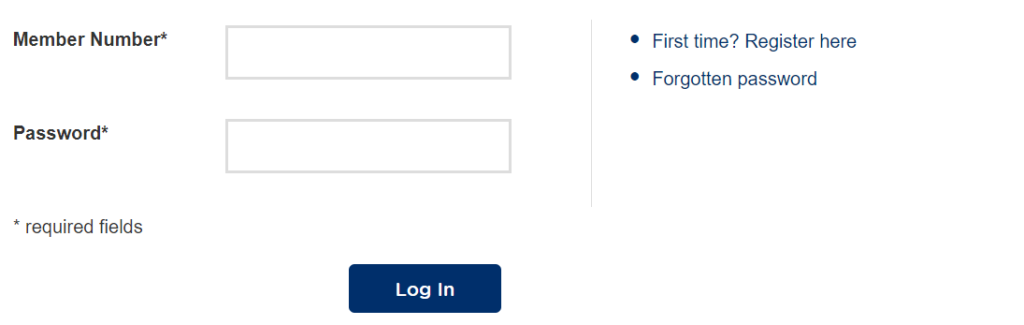

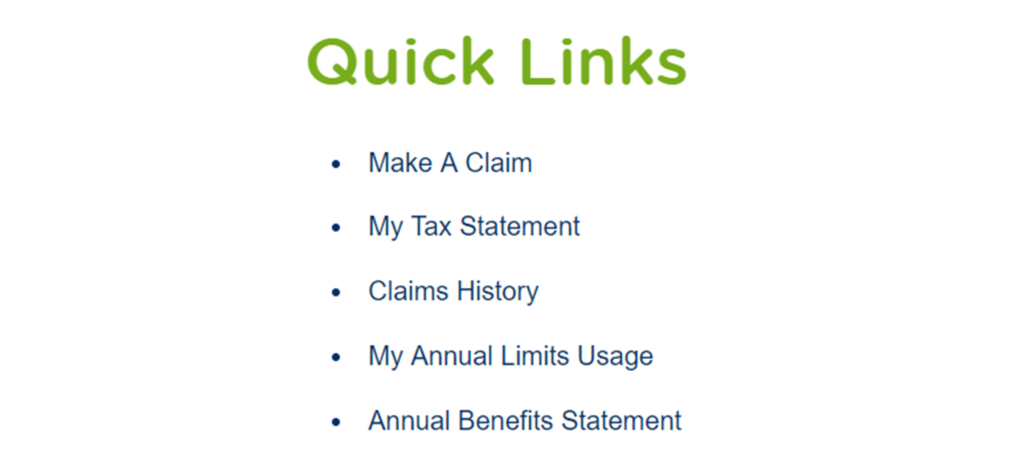

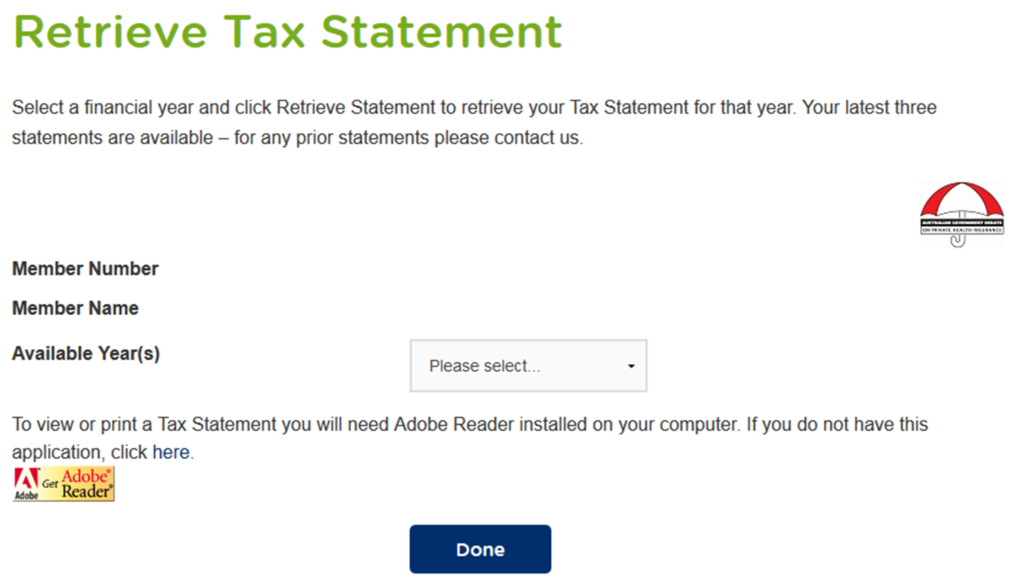

1. Go to the Online Member Services portal via the link or go to navyhealth.com.au and click on For Members at the top right hand side of the page.

2. Enter your log in details, register to use or retrieve your password.

3. Click on "My Tax Statement".

4. Choose the year you wish to view and click "Done".

|

|

30th June 2023 - The official end of the financial year. Navy Health will begin to work on creating your tax statement after this date if you held a hospital policy at any stage in the financial year. |

|

|

7th July 2023 - Tax statements will be available for members to view or download from Online Member Services. |

|

|

11th July 2023 - Your tax statement will be sent to the ATO where it will be viewable in your tax forms or your myGov portal. |

Why are you not sending the tax statement via email or post?

As per the recent changes to the legislation as part of the government reforms, Navy Health will no longer be mailing or emailing statements to members.

Where can I get a copy of my tax statement for my records?

You can log into Online Member Services and download all of your tax statements from here. Alternatively, you can speak to a Member Services Officer on 1300 306 289. Please note Navy Health estimates it can take up to 10 days for the tax statements to be received via post and recommend you download from Online Member Services.

Will I receive a tax statement?

If you held a hospital policy in the 2022/2023 financial year and you paid premiums toward it then tax statements will be available for members to view or download from Online Member Services.

Why is my tax statement not showing?

If your tax statement is not showing in Online Member Services and it is after the 7th July 2023, and you held an active hospital cover in the 2022/2023 financial year, please call us on 1300 306 289 so we can look into this for you.

If your tax statement is not automatically showing in your tax return, it is after the 13th July 2022, and you held an active hospital cover in the 2021/2022 financial year, please log into Online Member Services to download your tax statement to use for your tax return.

Navy Health cannot contact the tax department on your behalf.

Why does my statement have a zero in section J?

This is because Navy Health has not received any contribution payments toward your policy in the 2022/2023 financial year. This can occur if you have paid in advance in previous years.

Why does the benefit code (section L) shown on the statement differ to what I should be claiming?

Your statement will not show you what level of rebate you’re entitled to. This is because we don’t collect information about your income.

Back

Back

Mobile App

Members can claim using our Navy Health App. To download the App go to the App Store or Google Play Store.

Electronic Claiming

All you need is your Navy Health membership card to use the electronic claiming system. After a consultation, the service provider will swipe your card through the electronic claiming facility, enter the claim details and process the claim on your behalf.

Once the transaction has been authorised by Navy Health electronically, you simply pay the balance to the provider. The balance is the difference between the fee charged for the treatment and the amount covered by Navy Health. Ask your provider if they are connected to an electronic claiming system.

Online Claiming

You can make claims for most Extras services through Online Member Services. Claims for Orthodontic, Ambulance, Medically Prescribed Appliances and Pharmacy cannot be submitted via the Member Portal. They will need to be submitted via our claiming App or sent with a claim form.

Post, email and fax

A completed Navy Health claim form must accompany all manually submitted claims. Benefits will be paid via direct deposit into a nominated bank account (within Australia and excluding credit cards). Navy Health will hold the submitted receipts on your behalf; we are unable to return receipts.

Access a Navy Health claim form here.

Natural therapies include Acupuncture, Chinese Herbal Medicine, Myotherapy, Remedial Massage Therapy and Exercise Physiology.

Benefits are only payable for services rendered by a recognised provider in a private practice. Benefits are not payable on any prescribed medications, herbal or dietary preparations, or organised weight reduction programs.

The provider registration process for Natural Therapy services, including the issuing of provider numbers, is managed by the Australian Regional Health Group (ARHG) or Exercise and Sports Science Australia (ESSA) on behalf of Navy Health Limited.

Natural Therapy providers must be eligible members of an association that the ARHG recognises or a member of ESSA for benefits to be payable.

A referral from a registered practitioner must accompany MPA claims. This must be accompanied with a receipt showing your full name, date of purchase, name of device and details of the service provider the device was purchased from. (If purchased from a pharmacy, an official pharmacy receipt will be accepted.) The following are examples of items that can be claimed under the MPA category: Nebulisers*, Humidifiers*, Blood Glucose Monitors*, Heart Rate/Blood Pressure Monitors*, Support Aids/Mobility Aids, Compression Garments, Non-cosmetic Prosthesis (Premium Extras only), and TENS Machine/Circulation Booster*.

The MPA category also covers hire and repairs to appliances, up to the annual limit for this category.

*Navy Health will not pay benefits on any services, treatments or products received outside of Australia or when purchased from a provider without an Australian Business Number (ABN). As a consequence, we strongly advise all members to consider travel insurance when travelling overseas to cover emergency expenses when outside of Australia.

A CPAP device cannot be purchased more than once in any three (3) year period. The maximum three year replacement period commences on the first date of purchase.

Gold Cardholders

Members who become Veteran Gold Cardholders have the option of retaining or cancelling their cover with Navy Health. Where a member chooses to retain their coverage, benefits will be paid on out-of-pocket costs incurred after the Veteran Card payment; however the amount must not exceed the total charge or the Navy Health benefit limits.

For members with a Veteran Gold Card who hold top hospital coverage, Navy Health will pay the supplement (top-up) benefit for a private room in a private hospital.

Back

Back

Going to hospital can be daunting whether it be your first time or one of many. This information will take you through the steps of planning your upcoming admission and some important questions to ask.

Get prepared for your hospital visit by ensuring you’re fully aware of your condition, what your treatment will include and the cost of your treatment.

Contact Member Services at Navy Health on 1300 306 289 to discuss the following:

Your GP or Specialist is generally your first step before you receive hospital admission. They will analyse your condition, level of treatment and whether you will need help from other specialists. It is important to ask questions and discuss any tests or procedures you may need.

Some questions to consider are:

• What do I need to know about my condition, i.e. symptoms, tests and treatment?

• How long will I be in hospital?

• What are the expected costs? Will there be out-of-pocket costs?

• Does the specialist participate in the Access Gap scheme?

• Do I have the option to see a specialist of my choice?*

• What should I do to prepare for my admission?

• Will I need to take medication and if so, for how long?

• Are there any risks involved with my treatment?

• What is the duration of my admission?

• Are other specialists involved in the procedure?

Your doctor may recommend dates for your treatment or book your hospital admission during your appointment.

When organizing your pre-admission appointment, ensure you receive all the correct details and ask for an admission pack from the hospital outlining all the details.

*Refer to the Find a Specialist page for a free, comprehensive, up-to-date search directory of Australian private practising specialists and allied practitioners.

As an Australian resident holding a Medicare card, you are entitled to treatment as a public patient by a doctor employed by the hospital at a time set by the hospital, at no cost. All hospital inclusions such as accommodation, meals, medical and nursing care related to the treatment are also covered under Medicare. Because this is funded by Medicare, you do not need to have private health insurance to be treated as a public patient in a public hospital.

As a public patient in a public hospital, you’re more likely to incur longer waiting lists for elective surgeries. If you don’t mind waiting for your surgery, you may choose not to claim your treatment on your private health insurance and just enlist yourself as a public patient. In a private hospital, you’re likely to receive treatment sooner. You are also able to nominate your chosen doctor and choose from over 500 private hospitals. Navy Health’s contracted hospitals have an agreed level of fees that is charged by the hospital to Navy Health, to be paid on your behalf. If you choose a hospital outside of the 500 affiliated hospitals, you may be subject to out-of-pocket expenses.

Private hospital cover is designed to pay for hospital charges and to contribute to your doctor’s fees. Costs may be incurred if you have waiting periods, an excess or payments to your treatment practitioners who charge fees higher than those prescribed by the Government’s Medical Benefits Schedule. You may be able to reduce these costs if your doctor agrees to use Access Gap Cover.

There are generally two different ways your treating doctors may bill for their services. As a private patient, you are entitled to ask your treating doctors to give you Informed Financial Consent. This document will be given to you on request from your doctor and will tell you how much you will be “out-of-pocket” at the end of your planned hospitalization.

Access Gap

When treated as a private patient in hospital, members may face out of pocket expenses if the treating doctor charges more than the Medicare Benefits Schedule (MBS). The Access Gap scheme is designed to help minimise or eliminate these costs. Where an agreement is in place, and the treating doctor chooses to participate in the Access Gap Scheme, Navy Health is able to pay a further benefit towards medical expenses above the MBS. We encourage you to ask your treating doctors to use the Access Gap scheme to help alleviate any out of pocket expenses for your treatment in hospital.

Gap Medical

If your treating doctor does not participate in the Access Gap scheme, Gap Medical benefits will apply. Under Gap Medical benefits, Medicare will cover 75% of the MBS and Navy Health will pay the remaining 25% of the MBS. If the doctor charges more than the MBS fee, the member will be responsible for any ‘gap’ payment. The ‘gap’ is the difference between the MBS fee and the doctor’s fee.

Back

Back

| 1. | If you have viewed the Member Benefit Statement online, our system is set up to automatically generate one to your registered email address. |

| 2. | If you have had a medical or hospital episode in the past 12 months, it may be because Navy Health has just received and paid the account. If so, this statement is generated to members to inform them. |

The Member Benefit Statement is a notification to inform members of the medical and hospital episodes that Navy Health has received a bill for and what has been paid for on their behalf. The funds were paid directly to the hospital or the medical practitioner. If you have also paid money directly to the hospital or medical provider you will need to contact the hospital or medical provider to seek a refund of the monies you have paid, please contact Navy Health on 1300 306 289 for assistance.

The below sample contains definitions of fields to assist with your understanding of your Member Benefit Statement. Please note the definitions are for reference only and will not appear on your statement.

If you believe the information shown on your Member Benefit Statement is incorrect, please contact us on 1300 306 289.

Back

Back

The Private Health Information Statements (PHIS) are only a brief summary and we recommend you call Navy Health (1300 306 289) before making any decisions based on the statements.

It is a requirement that all Registered Health Benefits Organisations provide a PHIS for all Complying Health Insurance Products that are offered.

To view and download Navy Health Standard Information Statements, please go to the Private Health Insurance website.

Alternatively, you can request a PHIS for a particular product by email.

Back

Back

We value our members feedback so whether you want to pass on a compliment or feel that we have failed to meet your expectations we want to hear from you.

Paying a compliment

When you have received exceptional service from a Navy Health Members Services Officer or found something that you liked while using one of our services, we would like to hear from you.

Simply communicate your compliment(s) through one of the contact methods outlined in the Contact Us page.

Please ensure that any documentation is sent to the Chief Operations Officer and marked Private and Confidential.

What should I do if I have a complaint?

If for any reason you are not satisfied with the service you received from Navy Health or feel that it has failed to meet your expectations, we would appreciate your feedback. We are committed to resolving your complaints in a fair and efficient manner and view your feedback as a vital opportunity to improve.

Navy Health provides an accessible, impartial, free-of-charge complaints handling procedure.

To ensure you have the best possible customer experience, please make sure that you:

How do I lodge my complaint?

You can lodge your complaint in any of the following ways:

How will Navy Health handle my complaint?

Navy Health is committed to resolving your complaint the first time you contact us. We understand that it is important to listen to you and address each of your concerns.

We encourage you to discuss your complaint with the first Member Service representative you speak with, however, if you are not satisfied with their response to your complaint it will be escalated to their manager to review and resolve. We are confident that in most cases, our Member Service staff will resolve your complaint to your satisfaction.

If you are not satisfied that your complaint has been fully resolved, you have the option of escalating the matter to our Chief Operations Officer, who is dedicated to resolving issues from our Member Services staff in a fair, prompt and unbiased manner.

The Chief Operations Officer will investigate your complaint and contact you within five business days upon receipt of your correspondence, to resolve or advise you on the status of your complaint.

If I am not satisfied with the handling or resolution of my complaint?

If you believe that Navy Health has not made reasonable attempts to address your complaint or you are not satisfied with our resolution, you have the option of contacting the Private Health Insurance Ombudsman (PHIO).

This organisation is an independent office, appointed by the Federal Government, whose services are free to all health fund members. The PHIO handles enquiries, suggestions and complaints and will assist you in resolving a dispute. For more information on this service visit www.ombudsman.gov.au

If you wish to contact this service you may do so via any of the following channels:

To lodge a complaint visit www.ombudsman.gov.au

Or alternatively,

Call the Commonwealth Ombudsman on 1300 362 072

For general information about private health insurance visit www.privatehealth.gov.au

How to contact us

Phone: 1300 306 289 8:30am-6:00pm (AEDT) Mon-Fri

Email: query@navyhealth.com.au

Mail: Navy Health Limited, PO Box 172, Box Hill, VIC 3128

Fax: (03) 9880 7939

If you are contacting us to pay a compliment or make a complaint please ensure that any documentation is sent to the Chief Operations Officer and is marked Private and Confidential.

Back

Back

Benefits are not payable when:

| • | claims are over 2 years from the date of service |

| • | from the date the membership has been cancelled or transferred to another fund |

| • | where the supplier does not have a current ABN |

| • | where an item attracts a GST |

| • | the service performed is not included in your policy |

| • | the condition is deemed to be a pre-existing condition |

| • | the provider is not recognised in a private practice or for Natural Therapies the provider is not recognised by the Australian Regional Health Group (ARHG) or HICAPS |

| • | the service forms any part of a payment from Workers' Compensation, Third Party or any other liability provision. Navy Health reserves the right to seek full reimbursement on any benefits paid in these circumstances |

| • | the procedure does not have an assigned Commonwealth Medical Benefits Schedule item number |

| • | the claim is within a specified waiting or replacement period or annual/sub limits have been reached |

| • | Access Gap providers submit medical claims 2 years after the date of service, unless approved by Medicare Australia for benefits |

| • | services performed, or products from outside of Australia |

| • | cosmetic surgery |

| • | during a period of suspension or when membership is in arrears |

Navy Health will not pay benefits on any services, treatments or products received outside of Australia. As a consequence, we strongly advise all members to consider travel insurance when travelling overseas to cover emergency expenses when outside of Australia.

Back

Back

Navy Health allows new members who have not yet made any claims to cancel their policy and receive a full refund of any premiums paid within a period of 30 days from the commencement of their policy.

Back

Back

Membership premiums can be paid via direct debit, credit card, or via BPAY.

Failure to pay membership contributions within two months of your last "paid to date" (that is, the day to which your membership is paid up), will mean your membership and entitlement to benefits will cease. Once you have paid the arrears amount, your membership will resume and you will once again be entitled to benefits.

This agreement (“Direct Debit Service Agreement”) outlines the terms and conditions of the direct debit arrangements between the person signing the direct debit request (“you”)

and Navy Health (“us”). You agree to be bound by these terms and conditions upon your execution of the Direct Debit Request.

| • | We will, in accordance with the terms of the direct debit request and any other existing agreement, periodically debit the nominated account for the agreed amount(s) |

| • | The debits will occur according to the frequency you have nominated i.e. fortnightly, monthly or as agreed. The amount debited will vary according to the amount falling due |

| • | If any drawing falls due on a non-business day, it will be debited from the nominated account on the prior business day |

| • | You can change your direct debit arrangements by calling us on 1300 306 289 or logging into Online Member Services at members.navyhealth.com.au at least five (5) business days prior to the next direct debit. Changes include altering arrangements, stopping an individual debit or cancelling a direct debit request completely |

| • | We will give you at least 14 days notice by telephone or writing (including e-mail) of any change to the terms of the direct debit arrangements, unless otherwise agreed |

| • | If you believe we have drawn on your account incorrectly, please contact us on 1300 306 289 so the matter can be resolved. We will make every attempt to resolve the dispute within five (5) business days |

| • | You must ensure that:

→ before completing the direct debit request, you check the account details of your nominated account is accurate (check against a recent statement from your financial institution); → your nominated account can accept direct debits (your financial institution can confirm this); → nominated account has sufficient clear funds on the drawing date to allow payment to be made in accordance with the direct debit request and any other existing agreement between you and us. |

| • | You must advise us immediately if your nominated account is not current |

| • | If any drawing is returned or dishonoured by your financial institution, we may, at our discretion, reprocess the transaction following receipt of the notification of return or dishonour, or request an alternative form of payment from you. We may also charge any dishonour fees back to you |

If you require more information regarding this agreement, please contact Navy Health on 1300 306 289.

Back

Back

If you choose to use one of Navy Health’s preferred optical providers, you can receive an additional benefit (subject to the annual maximum). Navy Health's preferred optical suppliers can be found here*.

*Please note: the Optical Providers page is subject to change without notice.

Back

Back

Navy Health members can use Online Member Services to view details of their membership, claims history, update contact details, change coverage and more.

Back

Back

How do I order a replacement membership card?

You can order a replacement membership card online.

Alternatively, call us on 1300 306 289 or email query@navyhealth.com.au to request one or more replacement cards.

How do I order an additional membership card?

If you would like an additional membership card, to ensure your current card remains active, please call us on 1300 306 289. We will require the issue number of your current active card/s at the time of your call.

How long will my card take to arrive?

Navy Health membership cards are produced and posted off-site, so please allow up to two weeks for your card to arrive. If your membership card hasn’t arrived in that time, please contact us so we can investigate.

If you need to claim in the meantime, please pay for the service in full and submit a claim to us for a benefit refund.

Back

Back

At Navy Health, we understand that it may be necessary for you to suspend your health cover from time to time. Whether you are travelling, working overseas, or find yourself under some financial pressure, we can assist you with a temporary suspension of your membership. We allow you to put your policy on hold, with no premiums payable during the suspension period.

Please be aware that Members suspending their hospital cover are not considered to hold valid private hospital cover for tax purposes, so you may be liable for the Medicare Levy Surcharge (MLS) whilst suspended. The MLS may affect you if your taxable income exceeds the relevant threshold. Travel Insurance is not considered to be private hospital cover for MLS purposes. If you need to know more about the MLS and if it will affect you, please contact the Australian Tax Office on 13 28 61 or visit www.ato.gov.au.

Upon reactivation of your policy, a 12-month pre-existing condition (PEC) waiting period may apply for any condition that arose during your suspension period. PEC waits apply to Hospital cover only. No waiting periods will be applied to Extras services, provided all waits have been served before suspending your cover. Any waiting periods applicable prior to suspension will continue once your policy is reactivated.

A suspension can be applied for the following circumstances:

1. Financial Hardship: suspensions are available for a minimum period of three months and a maximum period of 12 months. There is a limit of 3 financial hardship suspensions over the lifetime of a membership. Suspension PEC waiting periods will apply upon reactivation of policy.

2. Overseas Travel: suspensions are available for a minimum period of one month and a maximum period of 24 months. Suspension PEC waiting periods will apply upon reactivation of policy.

3. Overseas ADF Postings: suspensions are available for a minimum period of one month and a maximum period of 24 months initially; this can be reviewed if the posting is extended. To avoid any waits on reactivation, the membership must recommence on the day you return to Australia. Upon reactivation of your membership, an International Record of Movement will be required for each covered adult.

4. ADF Member: suspensions are available to persons returning to full-time service in the Australian Defence Force. To avoid any waiting periods, your cover must commence the day after your full-time service is completed. A document showing your completion date will be required upon reactivation of your cover.

How do I suspend my policy?

To apply for a suspension, please complete an Application for Suspension form. Suspended memberships will automatically reinstate on the date nominated by you; Navy Health will contact you prior to confirm your reactivation date. If your policy is set to direct debit payments, these will recommence automatically upon reactivation.

A completed suspension form can be emailed to query@navyhealth.com.au. Please ensure you read the suspension terms and conditions below.

Terms and Conditions

Back

Back

A waiting period is an initial period of your health insurance membership whereby no benefit is payable for certain procedures or services. Waiting periods apply to both hospitals and extras cover. You may have a waiting period if:

| • | You join a health fund for the first time you will be required to serve the applicable waits on the hospital and/or extras |

| • | You upgrade to a higher level of cover, you will attract new waiting periods, however benefits at the previous level will still be available whilst the new waiting periods are being served. This also includes reducing an excess |

| • | You transfer from another fund before completing equivalent waiting periods |

** The 2 month waiting period may be waived for psychiatric care for persons upgrading to a higher level of cover, to specifically access in-patient mental health services. The following conditions apply:

| • | The person must have already served the 2 month waits on policy they are upgrading from (the restricted cover) |

| • | This waiver is only available once in a person's lifetime |

| • | 12 months for pre-existing conditions |

| • | 12 months for obstetrics (pregnancy) |

| • | 2 months for psychiatric care, rehabilitation and palliative care |

Can vary between insurers, however typical waiting periods include:

| • | 2 months for general dental and physiotherapy |

| • | 6 months for optical services |

| • | 12 months for major dental |

| • | 12 months for high cost procedures such as orthodontics & CPAP devices |

Back

Back

A pre-existing condition is where signs or symptoms of an ailment, illness or condition, in the opinion of a medical practitioner appointed by Navy Health existed at any time during the six (6) months preceeding the day on which you joined the insurer or transferred to a higher benefit cover.

This is irrespective of whether your medical practitioner, you and/or your dependants were aware of the condition or ailment.

The pre-existing condition rule also applies when resuming a suspended membership and symptoms or signs developed during the suspension period.

*Excludes Psychiatric, Rehabilitation and Palliative care.

Back

Back

Where a policy has an excess, the excess applies to the cost of in-patient hospitalisation in either a private, public or day hospital facility.

If your hospital cover comes with an excess, each adult on the policy is liable to pay the excess for a hospital admission once only within a 12-month period. There is no excess payable for children.

For singles, the excess is only payable once in any 12 month period (once the excess is paid in full). From the day you go into hospital, Navy Health will not charge another excess for a minimum of 12 months, or a partial excess amount if you have not yet paid a full excess amount for that 12 month period.

For families, the excess is payable per admission up to the family maximum of 2 admissions, in any rolling 12 month period.

Please note: reducing your excess is considered to be “upgrading” your membership. You will pay the higher excess amount for any hospital admissions within 12 months of upgrading

Back

Back

It is important that as a member of Navy Health you read and retain all the membership information provided.

It is your responsibility to notify us of any changes to your policy, including but not limited to address changes, bank account details or adding and removing people from the policy.

| Membership | Information on membership types, changing your details, paying your premiums, covering your children and suspending your membership. |

| Benefits | Information on when benefits can be paid, when benefits are not paid and overseas benefits. |

| Coverage | Information on waiting periods, pre-existing conditions, hospital excesses, using online member services, optical suppliers, prosthetic appliances and podiatry surgery information. |

| Claiming | Information on how to make claims, natural therapy claiming, Medically Prescribed Appliances and Veteran Gold Cardholders. |

| Covering the Gap | An explanation of the 'gap' and how you can reduce any potential out-of-pocket expenses when going to hospital. |

If you require further information, please don't hesitate to contact us on 1300 306 289.

Back

Back

Medically Prescribed Appliance claims must be accompanied by a referral from a registered practitioner. This must be accompanied with a receipt showing your full name, date of purchase, name of device and details of the service provider the device was purchased from. (If purchased from a pharmacy, an official pharmacy receipt will be accepted.)

The following are examples of items that can be claimed under the MPA category:

| • | Nebulisers |

| • | Humidifiers |

| • | Blood Glucose Monitors |

| • | Heart Rate/Blood Pressure Monitors |

| • | Support Aids/Mobility Aids |

| • | Compression Garments |

| • | Non-cosmetic Prosthesis (Premium Extras only) |

| • | TENS Machine/Circulation Booster |

The MPA category covers the purchase, hire and repairs to appliances that are covered under the category up to the annual limit.

Navy Health will not pay benefits on any services, treatments or products received outside of Australia or when purchased from a provider without an Australian Business Number (ABN).

Back

Back

How do I change my level of cover?

As an existing Member, you can change your level of cover by calling us on 1300 306 289.

Alternatively, you can make the change online.

Important things to know about changing your cover:

If you are unsure of the level of cover required, we would be happy to discuss your options; we can also advise of any waits applicable. Call us on 1300 306 289 for assistance.

Back

Back

Medical Devices and Human Tissue Product appliances or devices surgically implanted during a hospital stay are subject to two benefit types, either ‘no gap’ or ‘gap permitted’. These items are listed on the Commonwealth Prosthesis Schedule .

When a "gap permitted" benefit applies the insurer will pay the recommended minimum benefit as shown on the Schedule. The Schedule will have at least one no gap Medical Devices and Human Tissue Product for every in hospital procedure on the Medical Benefit Schedule (MBS) for which the insurer provides cover.

No benefit is payable where the hospital charges for a Medical Devices and Human Tissue Product appliance or device not listed on the Schedule.

Back

Back

Limited benefits are available when Podiatric Surgery is performed in a contracted hospital by an Australian Government Accredited Podiatrist. For further information, please call Navy Health on 1300 306 289.

Back

Back

Your extras policy will only cover pharmacy items that meet the following criteria:

| • | Not supplied or already covered under the PBS (pharmaceutical benefits scheme); |

| • | Are fully approved by the TGA (therapeutic good administration); |

| • | Are not experimental drugs or are part of a drug trial; |

| • | Prescribed by an Australian registered medical practitioner, including dentists and nurses; |

| • | Supplied by a registered Australian Pharmacist and are schedule 4 or 8 medicines only; |

| • | Are not vitamins, weight loss drugs, contraceptives, herbal medicines, over the counter pharmacy or non-prescription drugs. |

Please note: any drugs administered in-hospital that are not on the PBS may incur out-of-pocket expenses to be paid by you. Please ensure the hospital provides you with informed financial consent.

Back

Back

Medicare does not cover Ambulance cover and different states have different arrangements. Navy Health includes comprehensive ambulance cover on all policies. We cover 100% benefit for ambulance services within Australia provided by a state/territory registered ambulance service, by either Air/Sea or Land. We do not provide benefits for privately run patient transport services, such as Flying Doctor Services, Care Flight, etc.

Back

Back

Please complete this form if you are applying for a refund of the excess that you have already paid for a hospital admission. This form is only applicable to members on Corporate Health covers.

© Navy Health Ltd All Rights Reserved 2023

Privacy Policy Terms & Conditions Code of Conduct

© Navy Health Ltd All Rights Reserved 2023

© Navy Health Ltd All Rights Reserved 2023